WHAT IS A GOOD CREDIT SCORE IN AUSTRALIA 2022?

What is a good Credit Score in Australia 2022? In Australia, a good credit score is anything above 640. This means that if you want to take out a loan or apply for a mortgage, you’re more likely to be approved if your credit score is 640 or higher. Your credit score is a numeric representation of your creditworthiness.

A good credit score is important for anyone who wants to borrow money or apply for a loan in Australia. A bad credit score can mean you’ll pay higher interest rates on your loan, or you may not be approved for a loan at all. A good credit score can help you get a lower interest rate and save you money. In this article, we’ll discuss what a good credit score is and how to get one in Australia.

What is a Credit Score?

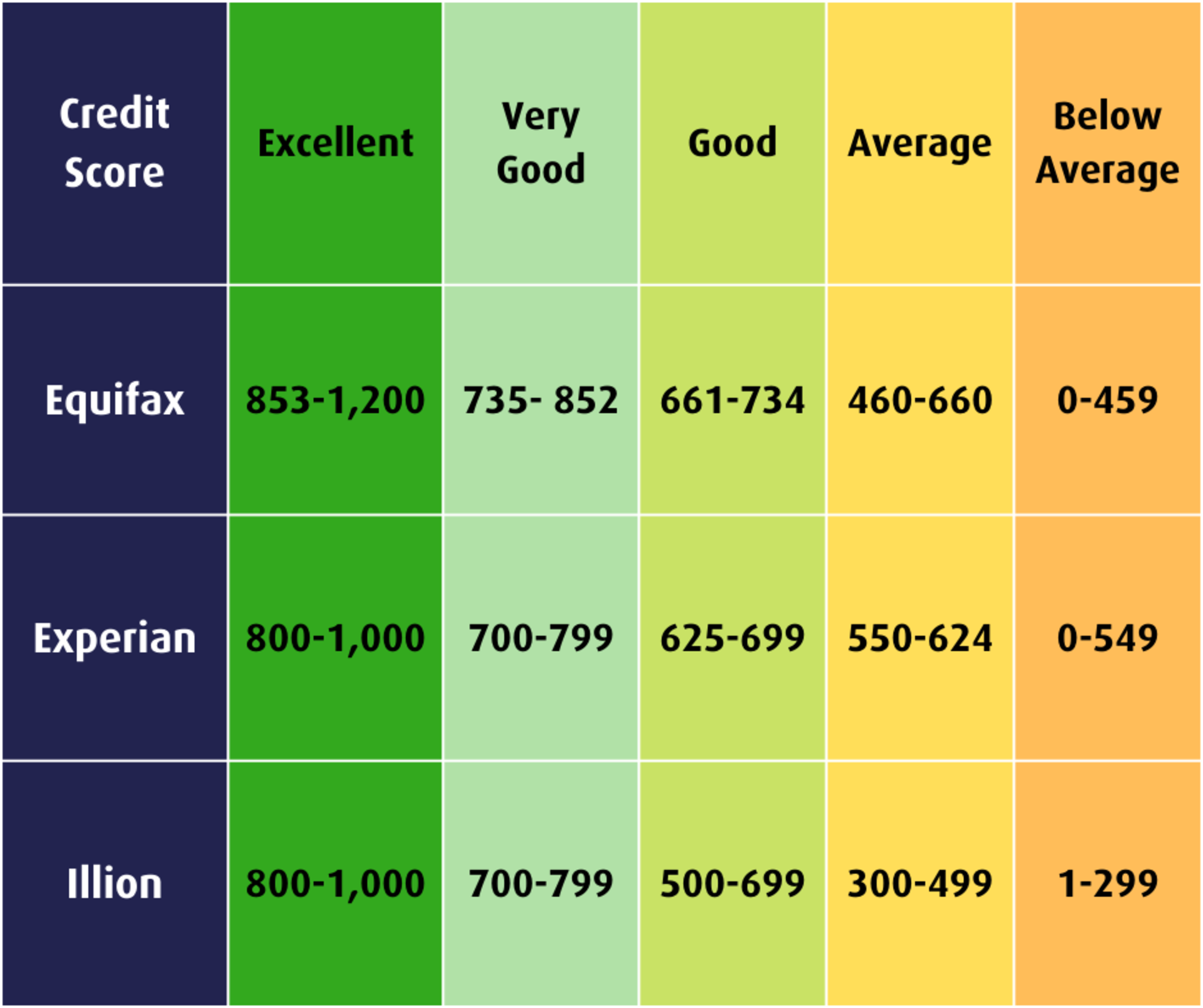

A credit score is a number that lenders use to determine how likely you are to repay your loan on time. The higher your score, the lower the risk you pose to lenders. In Australia, there are four main credit reporting agencies:

- Equifax

- Experian

- Illion and

- Trans Union

These agencies get their information from banks, financial institutions, and utility companies. They then use this information to create a report which is used to generate your credit score.

Your credit score can range from 0 to 1200, with 1200 being the highest possible score. Anything above 640 is considered to be good, while anything below 600 is considered poor.

A good credit score gives you access to more favorable loan terms and interest rates. It can also make it easier for you to rent a house or apartment, as landlords often check your credit score before approving your application.

How can I improve My Credit Score?

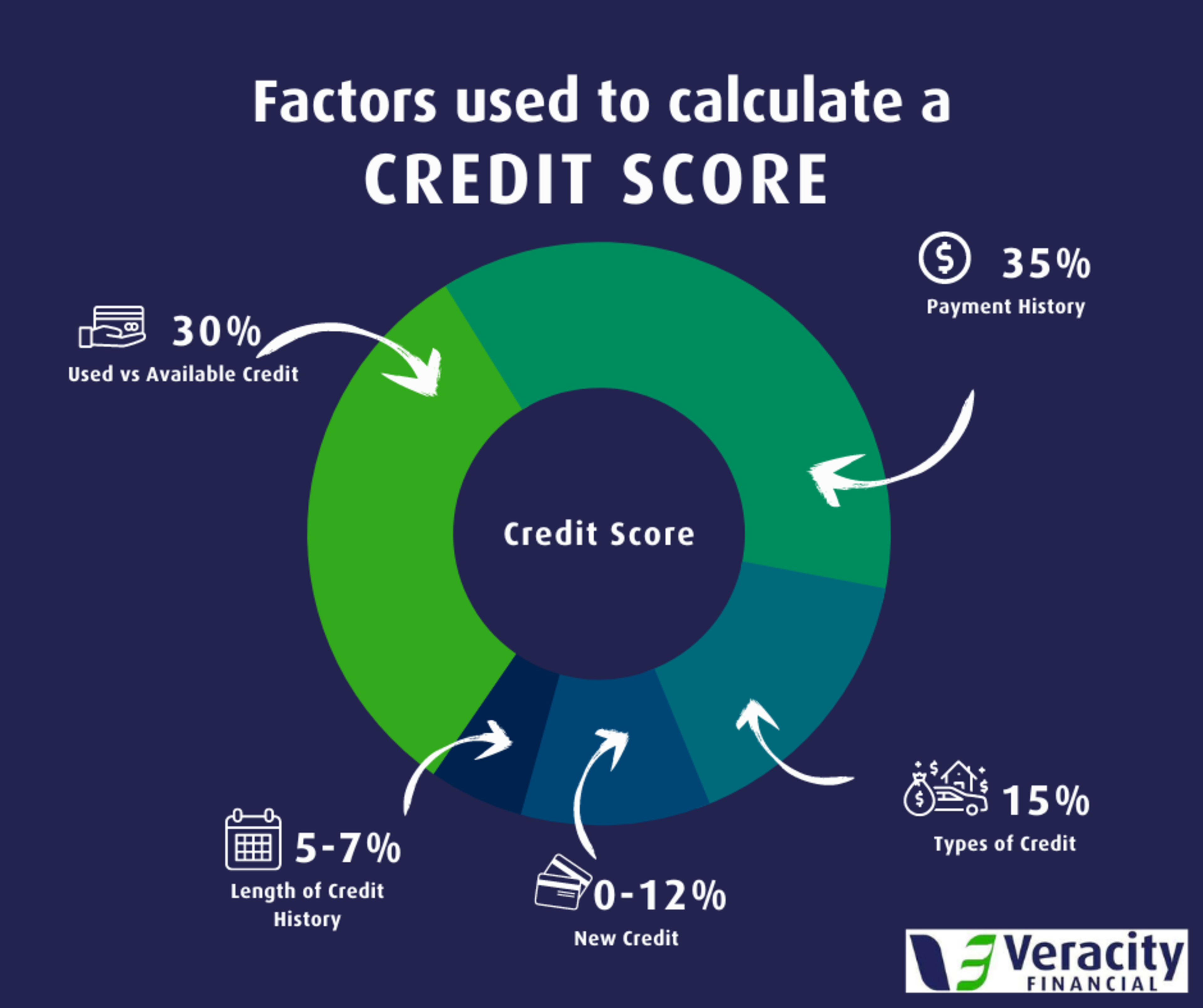

There are a few things you can do to improve your credit score:

- Make all your payments on time: This includes everything from utility bills to rent payments to credit card bills. If you have any outstanding debts, make sure to pay them off as soon as possible.

- Keep your balances low: If you have any debts, make sure that you’re not using more than 30% of your available credit at any given time. This shows lenders that you’re using your credit responsibly and that you’re not overextended.

- Check for errors on your reports: Sometimes mistakes happen. If there’s an error on your report, it could be dragging down your score unnecessarily. You can request a free copy of your report from us and dispute any errors that you find.

A good credit score in Australia is anything above 640 on a scale from 0-1200 with 1200 being the highest possible score. Anything below 600 is considered poor lending risk by financial institutions. You can improve bad credit by making all payments on time including utility bills and credit card bills among others; keeping balances low; and checking for errors on reports which can be requested for free from each of the four main agencies once per year.